People consume commodities on a daily basis. Commodities are raw materials, components, and ingredients almost everyone uses on a daily basis. You can name a few including coffee, sugar, cattle, gas, gold, silver, hogs cocoa, cotton and many more. However, whenever commodity trading is discussed, most people have the first impression that you should be wealthy to be part of this trading industry. They say that this is where the rich are getting richer. Quite frankly, true they are becoming rich because of commodity trading, but this does not necessarily mean that this type of trading is a money-making machine. What these rich people do is educate themselves about the trading.

Investment Vehicle

Joining Commodity Basis Trading can be truly your investment vehicle which requires you to understand several commodity trading strategies. In line with this, you should know how to identify opportunities when these are presented. You, on the other hand, is quite afraid when it comes to the risk. But, keep in mind that in a risk, there is always this opportunity that you should never let go.

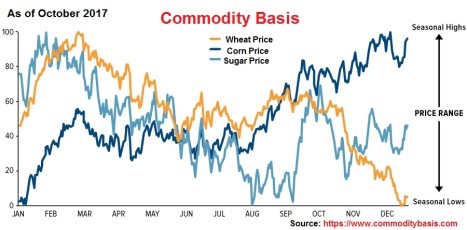

1 Understanding Seasonal Trading

Different commodities got their own different cycle on a yearly basis. If you know the science behind agricultural trading, in order for you to make sure that you are going to make out of money from your commodities, use this seasonal trading strategy. You can never go wrong with the seasonal tendencies prior to the demand and supplies. When it comes to the fundamentals of commodity trading, the seasonal tendencies has the potential of making your money grow. Of course, you still have to base your presumption on the commodity char and analysis and not just the season itself. In fact, most successful traders are using buy and sell signal software, hire commodity broker, trading market information, and use algorithmic trading.

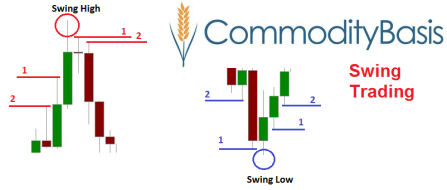

2 Swing Trading

Another way to start trading in this industry is to use the day trade also known as the commodity swing trading. This may take you at least half hour or so when looking for the trend in a day. This can be very crucial on your part in decision making. This strategy is probably the oldest trick in the book, but it is one of the most effective ways to grow your money in commodity cash trading. Choosing the right commodity physical trading, at the right time and at the right place can double or even triple your investment. In most cases, this is where the commodity brokers enhance their trading skills and build up their reputation.

3 Spread Trading

This kind of trading approach is, unfortunately, one of the most overlooked strategies for anyone who wants to make a trade in the commodity trading. The trader will look for a difference in price between the buyer and the seller side to narrow the option to the trader’s favor. This means that you are going to buy a contract in this month and keep this as an asset as it grows until the next month for the trade. For example, buying chicken meat commodity from the month of October and selling this on November since this is the season for Thanksgiving.